pa tax payment forgiveness

The following factors dont generally qualify as valid reasons for failure to file or pay a tax on time. Mail all payments with a payment coupon to.

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

Read important alerts or messages.

. Find your account number. Payments--The Secretary shall provide a payment in an amount up to 120. TCA 67-5-701 through 67-5-704.

There are ways to hasten your payoff date too. Will Cost Taxpayers over 300 Billion and Accelerate Record-High Inflation. Be sure to tell your loan servicer to apply any additional payments to your current balance rather than counting it toward next months payment.

View your student loan interest or cancelled debt for tax filing purposes. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in. Senator Pat Toomey R-Pa today criticized the Biden Administrations decision to force taxpayers to pay for the cancellation of student debt.

AP Larry Mitko voted for Donald Trump in 2016. How to Appeal a Penalty Relief Decision. Bidens Loan Forgiveness is a Grossly Unfair Taxpayer-Subsidized Handout to the Wealthy.

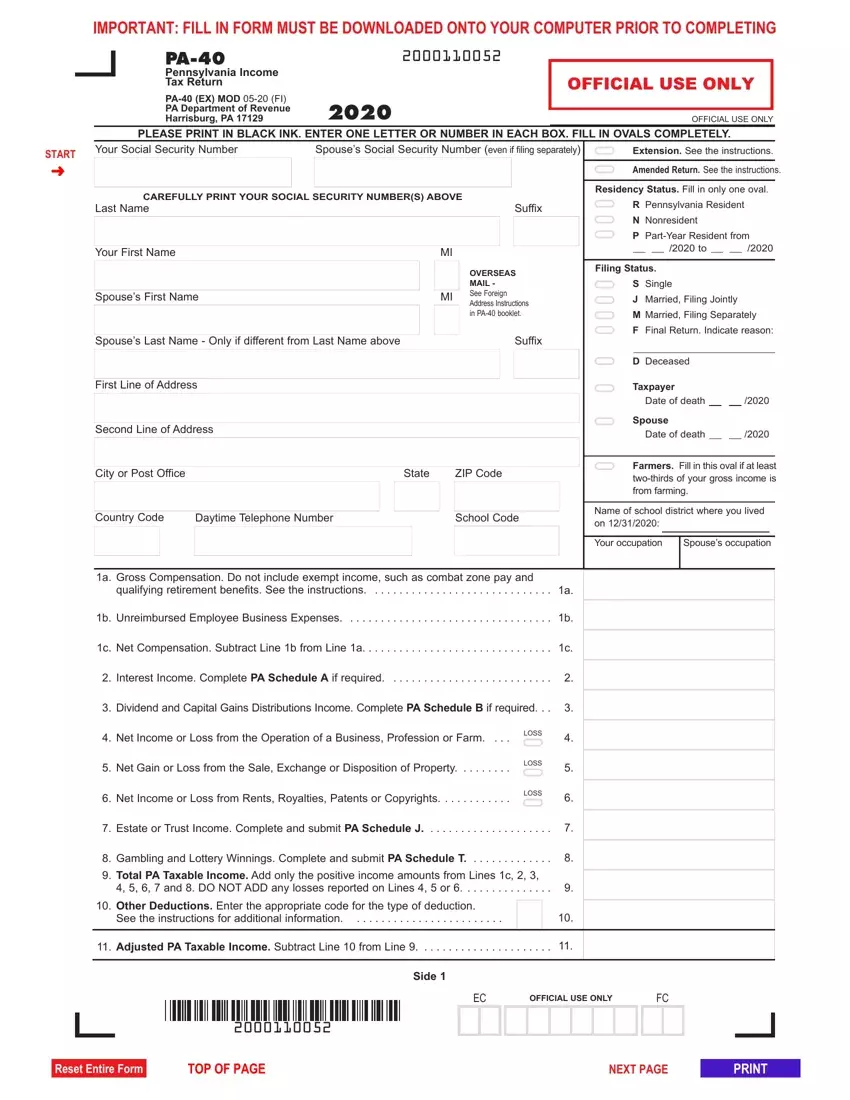

Modification of treatment of student loan forgiveness. For example a family of four couple with two. 2100210059 2100210059 2100210059 PA-40 2021 06-21 FI 28.

Reliance on a tax professional. If you received a notice or letter saying we denied your request for penalty relief see Penalty Appeal Eligibility for next steps. See the instructions for additional information.

Credits claimed on PA-40 Schedule OC for an individual taxpayer on his or her PA-40 Personal Income Tax Return cannot exceed the tax liability less the resident credit andor tax forgiveness credit. He can trumpet. Suspension of tax on portion of unemployment compensation.

1 I N GENERALSubject to paragraph 5 each individual who was an eligible individual for such individuals first taxable year beginning in 2018 shall be treated as having made a payment against the tax imposed by chapter 1 for such first taxable year in an amount equal to the advance refund amount for such taxable year. Or try the biweekly payment method. 7th St Harrisburg PA.

Student Loan Forgiveness Will Not Be Taxed in PA. If you want to do the math on your own paper return then complete sign PA Form PA-40 and Schedule PA-40X - Print Mail the Amended Return to PA Tax Department to one of the addresses below. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund.

Fill in oval if including Form REV-1630REV-1630A. Say your monthly loan payment is 500. For Public Service Loan Forgiveness to be beneficial you will have to switch payment plans.

Each year over 100000 individuals receive benefits from this 41000000 plus program. PA Tax Talk Electronic Payment Requirements. Underpayment of Estimated Tax by Corporations Penalty.

This line serves taxpayers without touch-tone telephone service. Of Revenue Payment Enclosed 1 Revenue Place Harrisburg PA 17129-0001 Refund Amendment Return PA Dept. American Education Services 1200 N.

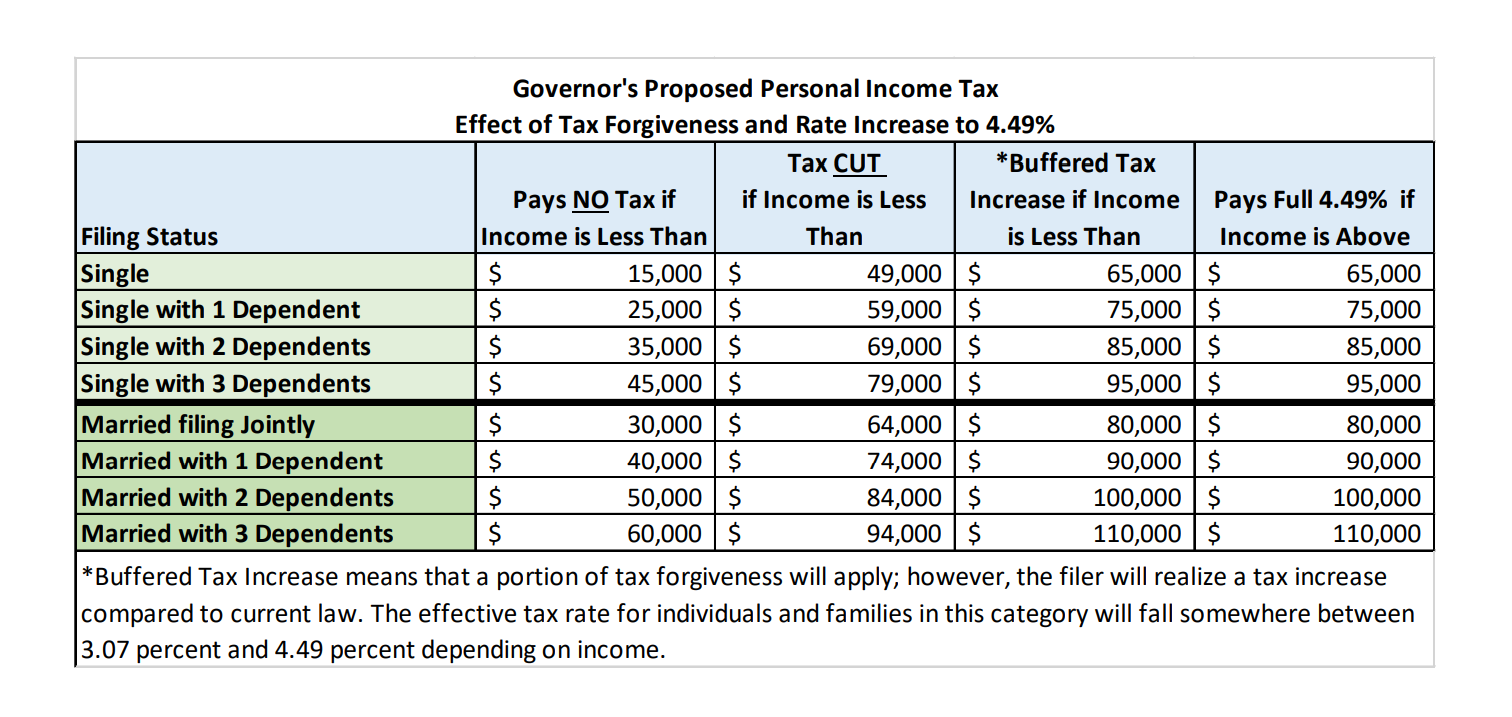

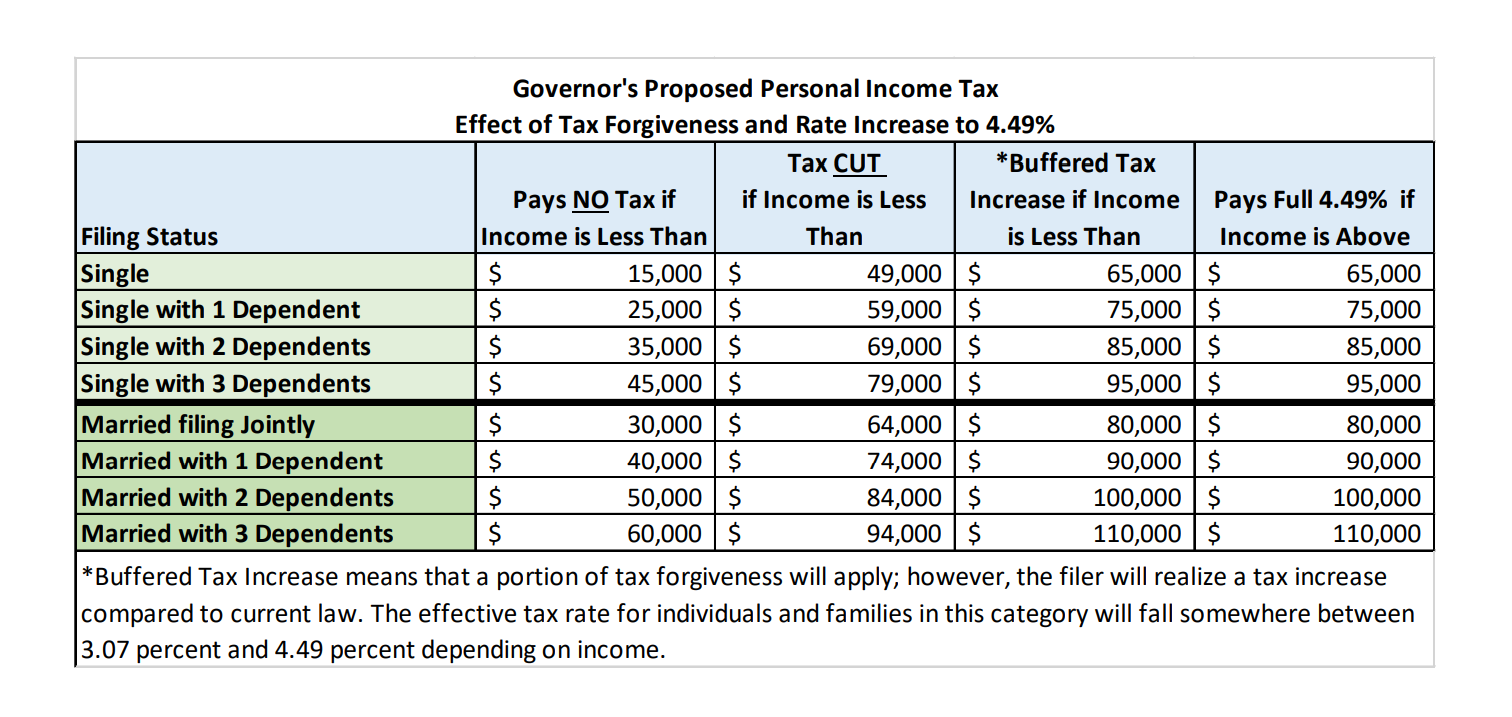

Underpayment of Estimated Tax by Individuals Penalty. Tax Due Amendment Return PA Dept. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

Tax filing and payment details for people who work in Philadelphia but dont have City Wage Tax withheld from their paycheck. To reduce or remove an estimated tax penalty see. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

On PA-40 Schedule SP the claimant or claimants must. Temporary delay of designation of multiemployer plans as in endangered critical or critical and declining status. For more information see Policy Statement 3-2.

Youre generally responsible for complying with tax law even if someone else handles your taxes. Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states. A Holocaust survivors surprising and thought-provoking study of forgiveness justice compassion and human responsibility featuring contributions from the Dalai Lama Harry Wu Cynthia Ozick Primo Levi and more.

Employment Incentive Payments Credit. Taxable Sale of a Principal Residence. People who meet the criteria can receive a refund of up to 05 on City Wage.

You must be eligible for Pennsylvanias Tax Forgiveness Program. File Form 1040 or 1040-SR by April 18 2022. Under a standard repayment plan you will repay your loans within 10 years and there wont be any.

Deductions for medical savings account contributions health savings account contributions and IRC Section 529 tuition account program contributions. Set up a Real Estate Tax payment plan for property you dont live in. Allowable Employee Business Expenses.

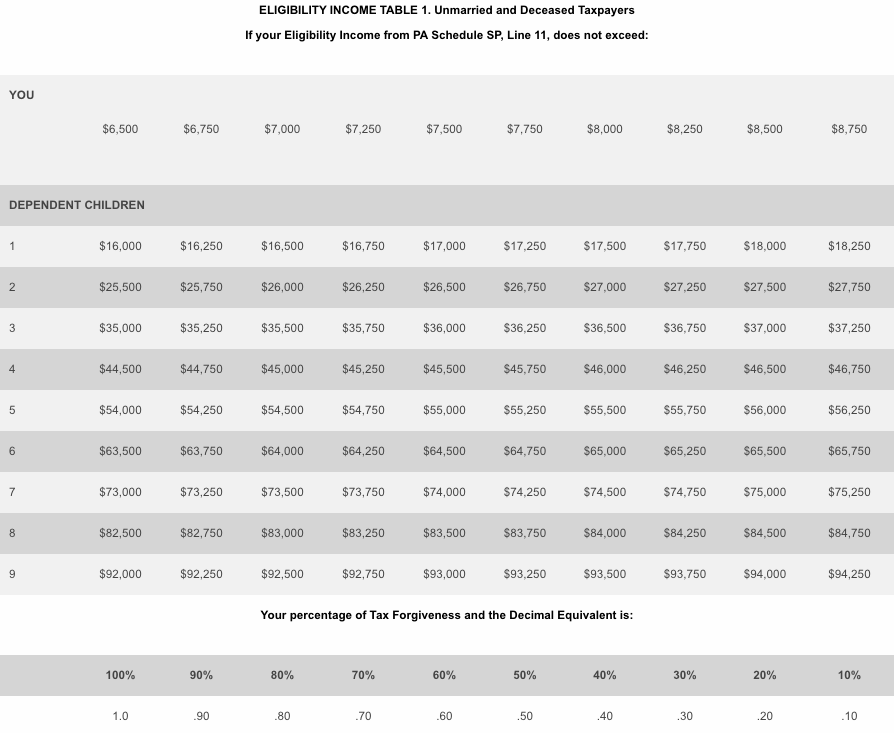

The Tax Relief section processes these applications and determines eligibility for the program. System issues that delayed a timely electronic filing or payment. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

Due date of return. AP To Democrats championing the White Houses student loan forgiveness plan it was the long-awaited delivery of one of President Joe Bidens campaign promises. 2022 Pennsylvania Estimated Tax Payment.

Learn more about July 8 2022 signed PA House Bill 1342 outlining the corporate net income tax rate change and sales and use tax on peer-to-peer car sharing updates. PA law allows three deductions against income. Construction worker median salary in 2020 was 37890.

Determine the amount of Pennsylvania-taxable income. Judge rules against podcaster seeking to run Ohio elections. 2021 PA-40 Payment Voucher.

For example a taxpayer with a 4000 tax liability who receives a 3000 resident tax credit cannot claim credits on PA-40 Schedule OC that. The White House has made it clear that most of the loan forgiveness plan 9-in-10 is for borrowers making less than 75000. Print 1098-E or 1099-C tax forms.

The Tax Relief Program began in 1973 as a result of the 1972 Question 3 constitutional amendment. PA Tax Talk is the Department of Revenues blog which informs taxpayers and tax professionals of the latest news and developments from the department. Read more Student Loan Forgiveness Scams on the Rise.

You could send extra money like tax refunds toward debt. Tom Wolf Governor C. Publication 3 - Introductory Material Whats New Reminders Introduction.

Income Tax Return Instruction Booklet PA-40 2021 Pennsylvania Personal Income Tax Return Instructions PA-40 IN email protected Automated 24-hour Forms Ordering Message Service. Featured Pages Taxation Topics.

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue

Ivca Ispirt Demand Better Tax Regime Nasscom Supports Govts 2030 Vision Here S Everything Indian Private Student Loan Payment Tax Refund Student Loan Repayment

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Pennsylvania Pa State Tax H R Block

Pennsylvania Budget Has New Tax Credits Rebates

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Pennsylvania Will Eliminate State Income Tax On Student Loan Forgiveness Phillyvoice

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

Increase The Threshold For Qualifying For Tax Forgiveness Pennlive Letters Pennlive Com

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Pa Business Community Applauds Budget Cut In Corporate Income Tax But Want More Done Pennlive Com

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Loan Originator Debt Relief

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More